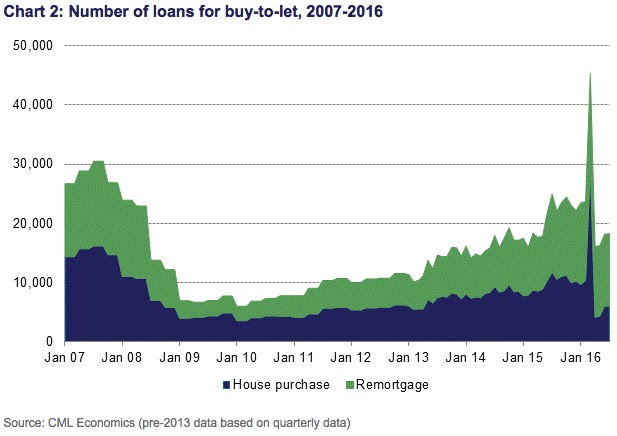

CML Buy to Let Lending data for July 2016.

Gross buy-to-let lending, while lower than levels we saw last year, saw the highest monthly levels of activity by volume and by value since the stamp duty changes on second properties came in on April

It is BTL remortgage lending that continues to be the majority of the market place, making up two-thirds of BTL gross lending.

CML director, Paul Smee comments

"These figures cover the first full month of lending following the EU referendum. They show a month-on-month decline in first-time buyer and home mover activity and muted activity on the BTL market. It is hard to determine whether these figures reflect a first uncertain reaction to the referendum vote, or are a sign of a market which was already cooling. It will be quite some time before a full assessment can be made. We do believe that the Buy-to-let lending market is still readjusting after the large level of activity before the changes to stamp duty on second properties in April.

Remortgage lending on the other hand has continued to grow, and reacted with a 7-year monthly high. Borrowers seem keen to take advantage of the wide range of competitive deals in the market and, following the base rate cut in August, this is likely to continue."

Residential lending for July

- Home-owners borrowing at £10.6bn, down 13% on June

- Total number of loans at 58,100, down 14% on June

- First-time buyers loaned £4.4bn, down 19% on June.

CML director, Paul Smee comments

"These figures cover the first full month of lending following the EU referendum. They show a month-on-month decline in first-time buyer and home mover activity and muted activity on the BTL market. It is hard to determine whether these figures reflect a first uncertain reaction to the referendum vote, or are a sign of a market which was already cooling. It will be quite some time before a full assessment can be made. We do believe that the Buy-to-let lending market is still readjusting after the large level of activity before the changes to stamp duty on second properties in April.

Remortgage lending on the other hand has continued to grow, and reacted with a 7-year monthly high. Borrowers seem keen to take advantage of the wide range of competitive deals in the market and, following the base rate cut in August, this is likely to continue."

Take advantage of our discounted landlord insurance ratesBrexit effect chills the housing market in July > client @SPFPrivClients comments https://t.co/EyTN4Bi648 via @ThisIsMoney— Melanie Bien (@melaniebien) 15 September 2016

No comments:

Post a Comment