| Max LTV | Initial Rate | Term | Completion fee | Booking fee | Incentives | Lender |

| 80% | 2.64% Discount | 2 Years | 0% | £0.00 | No | Hanley Economic Exclusive |

| 80% | 3.35% Fixed | 2018-11-30 | £1999 | £150.00 | Free Valuation | Mortgage Trust Exclusive |

| 80% | 4.89% Discount | 3 Years | 2% | £0.00 | No | Saffron BS Semi Exclusive |

| 75% | 2.28% Fixed | 2018-10-31 | £999 | £0.00 | No | Newcastle Building Society |

| 75% | 2.59% Fixed | 2018-11-30 | £1999 | £150.00 | Free Valuation | Mortgage Trust Exclusive |

| 75% | 2.71% Fixed | 2018-10-31 | 0% | £0.00 | Free Standard Valuation (on properties up to and including £500,000) and Free Standard Legal Fees. Newcastle Building Society will pay for some of the legal fees for the re-mortgage including the basic professional fee and standard disbursements. The basic fee payable does not include a Telegraphic Transfer Fee (£30) where this fee is applicable and any non standard work such as but not inclusive too : Assured Short hold Tenancy Checks, Transfer of Equity, Removing Second or Subsequent Charges and Completing electronic Identification Checks. | Newcastle Building Society |

| 75% | 2.95% Fixed | 2018-11-30 | £1499 | £150.00 | Free Valuation and free standard legal services (other fees may apply). | Mortgage Trust Exclusive |

| 75% | 3.24% Tracker | 0 Years | 1.25% | £0.00 | No | N & P Ltd Company |

| 75% | 3.49% Fixed | 2022-01-31 | 2% | £125.00 | No | Foundation Semi-Exclusive Ltd Company |

| 75% | 3.66% Tracker | 2 Years | 1.5% | £100.00 | No | Axis Specialist |

| 65% | 3.55% Fixed | 2019-10-31 | £1499 | £150.00 | No | Paragon Semi-Exclusive Premier Ltd Company |

Friday, September 30, 2016

Most popular BTL mortgages

Sept sees slower property price growth

- House prices increased by 0.3% in September

- Annual house price growth slowed to 5.3%, from 5.6% in August

“The pace of annual house price growth slowed to 5.3% in September, from 5.6% in August, though it remained within the narrow range of 3% to 6% that has prevailed since early 2015.

The relative stability in the rate of house price growth suggests that the softening in housing demand evident in recent months has been broadly matched on the supply side of the market. Survey data indicates that, while new buyer enquiries have remained fairly subdued, the number of homes on the market has remained close to all-time lows, in part due to low rates of construction activity (discussed in more detail opposite).

Regional price trends were also little changed. Regions in the south east of England continued to record the strongest gains even though price growth slowed noticeably in the Outer Metropolitan region (from 12.4% in Q2 to 9.6% in Q3) and in London (from 9.9% in Q2 to 7.1% in Q3).

“House price growth remained subdued in Scotland (+2%) and Northern Ireland (+2.4%) and small price declines were recorded in Wales (-0.5%) and the North of England (-0.2%), all relative to Q3 last year (see page 3 for more commentary on regional house price trends). "

Housing supply

“The number of new homes built in England has picked up, but is still not sufficient to keep up with the expected increase in the population. In the four quarters to Q2 2016, 139,000 new houses were completed, 30% higher than the low point seen in 2010. However, this is still around 15% below the average rate of building in the five years before the financial crisis and 38% below the 225,000 new households projected to form each year over the coming decade."

House price growth slows with the south of England bearing the brunt https://t.co/XsLwtfBqRK

— Telegraph Property (@TeleProperty) September 30, 2016

House price growth slows during September #mortgages https://t.co/gVO4xk84fn

— FTAdviser (@FTAdviser) September 30, 2016

House price growth slows, says Nationwide, but 'remains in range' https://t.co/PRXWa6Jmzh— BBC Business (@BBCBusiness) September 30, 2016

London developers not building family homes

Take advantage of our discounted landlord insurance ratesChanges to stamp duty are driving London property developers to give up on building famliy homes https://t.co/OEH2TW9FRQ pic.twitter.com/e06pYO68BN

— MoneyWeek (@MoneyWeek) September 29, 2016

Thursday, September 29, 2016

BTL borrowers to face more scrutiny

Take advantage of our discounted landlord insurance ratesBuy-to-let borrowers to face more scrutiny https://t.co/iN4rAeqpgp

— Finance News (@ftfinancenews) September 29, 2016

Will I pay CGT if I sell my BTL?

Take advantage of our discounted landlord insurance ratesWill I pay CGT if I sell my buy-to-let to help fund a new home? https://t.co/Yg7OwVvpMR

— The Guardian (@guardian) September 29, 2016

Airbnb denies pushing up London rents

Take advantage of our discounted landlord insurance ratesAirbnb denies it is to blame for rising rental costs in London https://t.co/1ptd360CSg

— Sky News (@SkyNews) September 28, 2016

A 'Birmingham and Manchester' boom

Take advantage of our discounted landlord insurance ratesA familiar problem follows Londoners flocking to Britain's second cities: pricey property https://t.co/pjqAv8Lddt pic.twitter.com/Ds2xdbDkQT

— The Economist (@TheEconomist) September 28, 2016

Plans for flood risk symbols

Take advantage of our discounted landlord insurance ratesPlans for 'flood risk' symbols on homes prove controversial https://t.co/assJZZh6My

— BBC Business (@BBCBusiness) September 28, 2016

ONS August data on private rents

- Private rental prices paid by tenants in Great Britain rose by 2.3% in the 12 months to August 2016, down 0.1 percentage point compared with the year to July 2016.

- Private rental prices grew by 2.4% in England, 0.1% in Wales and were unchanged in Scotland (0.0%) in the 12 months to August 2016.

- Rental prices increased in all the English regions over the year to August 2016, with rental prices increasing the most in the South East (3.4%).

Take advantage of our discounted landlord insurance ratesPrivate rental prices in North of Eng rising at slower pace than those in South and East https://t.co/PZ9eR365oK— ONS (@ONS) September 29, 2016

London earning growth and rent inflation

Take advantage of our discounted landlord insurance ratesPrivate renters in London experiencing acute gap between average earnings growth and rent inflation pic.twitter.com/U7cq09icPY

— ResolutionFoundation (@resfoundation) September 29, 2016

Council call for business rates on HMOs

Brighton and Hove has 15,000 Houses in Multiple Occupation, the highest number in the country.

Our universities contribute hugely to the city. We need to find a happier balance between the costs and benefits of being a university town. We are looking at more enforcement and regulation of HMOs, we will work with the universities to try to make neighbourhoods as well-maintained as possible, but the government needs to play its part as well by helping us offset the additional costs.”

Time to invest in social housing

Private firms will never build enough homes: time to invest in social housing https://t.co/cefZN76aqZ

— Guardian Housing (@GuardianHousing) September 28, 2016

Wednesday, September 28, 2016

Low interest rates forever - says BofE Dep.Gov

Take advantage of our discounted landlord insurance ratesQE is here forever, says Bank of England deputy governor https://t.co/SJ7qNRgRbd

— Telegraph Business (@telebusiness) September 28, 2016

One in seven Scottish homes are PRS

Take advantage of our discounted landlord insurance ratesThe growth of the private rented sector in Scotland https://t.co/86SUNDo32Z #property

— NALScheme (@NALScheme) September 28, 2016

A peak in flat sales - ONS data

Take advantage of our discounted landlord insurance ratesSales of flats more than double the 5 year average in March 2016 https://t.co/ErA17JtsMw pic.twitter.com/mvkKHDMXSD

— ONS (@ONS) September 28, 2016

Labour to build 500,000 social homes

Take advantage of our discounted landlord insurance ratesLabour will suspend the Right to Buy and build 500,000 social homes writes shadow housing minister @tpearce003 https://t.co/aPzio7Q2Vz pic.twitter.com/8k18WtUhEW

— Inside Housing (@insidehousing) September 28, 2016

Most affordable commuter towns

Take advantage of our discounted landlord insurance ratesMost affordable commuter towns revealed including Wellingborough https://t.co/urc0fQgEAT

— This is Money (@thisismoney) September 27, 2016

Rates for 5 yr fixed BTLs hit low

The average five-year fixed rate for a 60 % LTV on a BTL fell to just 3.48% .

Charlotte Nelson, from Moneyfacts.co.uk,

"All LTVs for five-year fixed rates have reached the lowest in the market this month.

Low rates may make BTL an attractive option, but borrowers should remember that a BTL investment is not without its risks, so it is important for any potential landlords to seek financial advice,”

Tuesday, September 27, 2016

8 million expect to rent forever

Take advantage of our discounted landlord insurance ratesNew research claims 8 million people expect never to own their own home https://t.co/vwqkVRkllf #property cc @katefaulkner

— NALScheme (@NALScheme) September 27, 2016

Big fall in mortgage lending

Take advantage of our discounted landlord insurance ratesMortgage approvals off a cliff https://t.co/MItaHW8ZaK

— This is Money (@thisismoney) September 27, 2016

Additional landlord licensing in Lewisham

Take advantage of our discounted landlord insurance ratesNew additional licensing scheme by @LewishamCouncil. Now includes all HMOs in buildings above commercial premises. https://t.co/FCE4IatDH8

— Dean Underwood (@DeanUnderwood01) September 27, 2016

Sunday, September 25, 2016

Sharp drop in London new builds

Take advantage of our discounted landlord insurance ratesThe number of new properties being built in London has dropped dramatically https://t.co/LxlU0ZXT5U #property

— Phillips&Stubbs Rye (@PhillipsStubbs) September 22, 2016

Saturday, September 24, 2016

Right to buy pledge not met

Take advantage of our discounted landlord insurance ratesRight to buy: one-for-one replacement pledge not being met, data suggests https://t.co/CxrHZQDTcB #ukhousing

— Guardian Housing (@GuardianHousing) September 22, 2016

The average first time buyers age

Where are the youngest first-time buyers in the UK? https://t.co/Ug1rblXeip

— Telegraph Property (@TeleProperty) September 22, 2016

Take advantage of our discounted landlord insurance ratesFirst-time buyers must wait seven years longer for home in south-east England https://t.co/ydOgrze9p1

— Guardian news (@guardiannews) September 23, 2016

Changing from sole to joint tenancy

We have had a recent post from a landlord looking to change a tenancy from a sole tenancy to a joint tenancy as a result of a recent cohabitation of tenants. This is an interesting question as you don't want to be caught out..should you us a deed of variation for instance.

We have also covered the opposite where tenants break up and the tenancy needs to change from a joint to a sole tenancy.

Things never stand still when it comes to the occupation of your rental properties so keeping the legal documentation up to date and relevant is critical.

Landlord insurance - where to get expert brokers - online rates

Friday, September 23, 2016

Weymouth HMO landlord fined

Take advantage of our discounted landlord insurance ratesDorset landlord prosecuted for HMO failings https://t.co/pI9R6KW37z

— TfP (@TFPOnlineLtd) September 13, 2016

Thursday, September 22, 2016

HMRC to tackle stamp duty avoidance

Take advantage of our discounted landlord insurance ratesHMRC to tackle new wave of stamp duty avoidance #stampduty #hmrc https://t.co/5xeIIYqCl4

— FTAdviser (@FTAdviser) September 22, 2016

Keeping quiet about your BTL

Take advantage of our discounted landlord insurance ratesAn asset class that dare not speak its name https://t.co/LRtAMxkWrP #property

— Property PR (@propertypr) September 22, 2016

CML report housing market recovery

CML's senior economist, Mohammad Jamei comments:

"Widely voiced fears in recent months about the housing market have proved to be wide of the mark. Prospects for house purchase activity post-referendum look slightly subdued, when compared to late 2015 and early 2016. However, sentiment in the market recovered in August. This is reflected in stronger-than-expected transaction figures, and in our gross lending estimate.

This recovery in sentiment is likely to be down to a number of different factors, including the Bank of England’s monetary stimulus and its introduction of the Term Funding Scheme in August. A subsequent uptick in approvals is anticipated, albeit still at levels lower than earlier this year as affordability constraints and lack of properties on the market for sale continue to bear down on borrowers. The Bank also continues to indicate another rate cut on the cards, if medium term prospects remain unchanged."

Mortgage lending climbed in August, says CML > client @SPFPrivClients comments https://t.co/KwCOEW5rrD

— Melanie Bien (@melaniebien) September 22, 2016

Take advantage of our discounted landlord insurance rates

The first property ISA

Take advantage of our discounted landlord insurance ratesFirst property ISA attracts backing from Zoopla https://t.co/L4R4wby72k via @telebusiness>>@bricklanedotcom

— Robin Klein (@robinklein) September 22, 2016

Trip Advisor style site for tenants

Take advantage of our discounted landlord insurance ratesAngry tenant launches Trip Advisor style review site for rental properties https://t.co/3BpjA0j4kF #property

— NALScheme (@NALScheme) September 21, 2016

Tenancy deposits reflect PRS growth

The total value of these deposits was £3.567bn, up £379m over the year.

The average deposit remains static at £1,041.

Steve Harriott Chief Executive of the Tenancy Deposit Scheme and the new TDS Custodial scheme comments:

“These figures demonstrate the continuing growth of the private rented sector, which is now larger than the social housing sector in England and Wales. The huge number of deposits being paid by tenants at a value of some £3.5bn demonstrates the need for tenancy deposit schemes to ensure that deposits are protected for tenants."

Take advantage of our discounted landlord insurance rates

Tenants hit by online rental frauds

Take advantage of our discounted landlord insurance ratesWould-be tenants hit by rise in online 'rental fraud'https://t.co/fO5HivdYmn pic.twitter.com/jjCA6QqjrV

— Telegraph Money (@MoneyTelegraph) September 22, 2016

Selective licensing in Redbridge?

Take advantage of our discounted landlord insurance ratesShould selective licensing be introduced in #Redbridge - have your say https://t.co/FhaC8pKo2l pic.twitter.com/IvOn3nX5ij

— LondonPropLicensing (@lplicensing) September 22, 2016

Wednesday, September 21, 2016

99 facts about fire doors

Take advantage of our discounted landlord insurance ratesWould you like to know some facts about #firedoors?

— FireDoorSafetyWeek (@FDSafetyWeek) September 20, 2016

Well we've got 99 of them! Take a look: https://t.co/fhRUyAZwMo pic.twitter.com/ug24L6K07i

Latest Prime London Property report

Our new Prime London Report (with revised forecasts) out today https://t.co/BCv7EA9PN6 pic.twitter.com/xDkSb6CYqP

— Lucian Cook (@LucianCook) September 21, 2016

Take advantage of our discounted landlord insurance rates@LucianCook & @JudithREvans on the market now & the future but for $ or € buyers we say fortune favours the brave https://t.co/Y7JTn7YqVA

— Anthony Payne (@Anthony_Lonres) September 21, 2016

Tenants win leaky counterclaim

Take advantage of our discounted landlord insurance ratesFergus Wilson blames tenants for leak to water tank, sues for £4K. Ts defend, counterclaim for disrepair, win £2500. https://t.co/LXIcKoOHRL

— Nearly Legal (@nearlylegal) September 21, 2016

Tuesday, September 20, 2016

London's luxury student accommodation

Take advantage of our discounted landlord insurance ratesWe don't remember our student halls looking like this... https://t.co/p9cCHNDKxk pic.twitter.com/rGON0IXSUZ

— ES Homes & Property (@HomesProperty) September 19, 2016

Campaign to ban £115m agency fees

Take advantage of our discounted landlord insurance ratesCampaign Grows To Ban £115 Million-A-Year Estate Agent Fees - @psmith reports on our & @CitizensAdvice's new numbers https://t.co/GlWV4gO6jj

— Generation Rent (@genrentuk) September 19, 2016

BTL investors to sue Skipton and BofI

Take advantage of our discounted landlord insurance ratesBuy-to-let investors to sue over Skipton and Bank of Ireland mortgage costshttps://t.co/TRaeUo8vl0 pic.twitter.com/WfvT5qLOtM

— Telegraph Money (@MoneyTelegraph) September 16, 2016

Asking prices start to recover

- Prices of property coming to market up 0.7% (+£2,277) following a 2.0% fall

- Prices of smaller properties coming to market ( 2 beds or less ) up 3.3% (+£6,240)

- Asking prices now almost £20,000 (+10.5%) higher than a year ago in this sector

- Seven out of 10 regions see asking prices rise or standstill

- First full week of September sees visits to Rightmove up 8% on same period in 2015

Rightmove's Miles Shipside, comments:

The rising tide of prices is marooning more and more first-time buyers, out-stripping their ability to meet stricter lending criteria and afford the required deposits and monthly repayments. Increasing numbers are being cut off from home-ownership altogether and while schemes are in place to help, the additional demand they create is not matched by available and affordable supply. With an average rise of over 10% in prices of typical first-time buyer properties over the last 12 months, minimum entry prices in some locations will go above what lenders are able to lend to most aspiring first-time buyers. Ironically the post-referendum uncertainty has made some sellers of larger and higher value homes more willing to negotiate, making it easier for those already on the ladder to trade up. There appear to be no such positives at present for those hoping to get onto the property ladder, especially as agents report more investor activity attracted by better returns than available elsewhere.

The market continues to shake off the effect of post-Brexit vote uncertainty, though more so in the lower end sector. Buyers are still looking and enquiring, but there are limits on their willingness or ability to pay over the odds so sellers should be wary of over-pricing unless their local market can really justify it.”

PRS has a problem with damp

Take advantage of our discounted landlord insurance ratesMore than 1 in 10 private renter households in poverty have a problem with damp https://t.co/m3LqmQvpP7 pic.twitter.com/JD9inyytYR

— New Policy Institute (@npi_research) September 19, 2016

2 in 5 tenants are over 46

Two in five tenants across the UK are at least 46 years old > client @Anderson_Harris comments https://t.co/ktmgilV5Kw via @MailOnline

— Melanie Bien (@melaniebien) September 20, 2016

Take advantage of our discounted landlord insurance rates

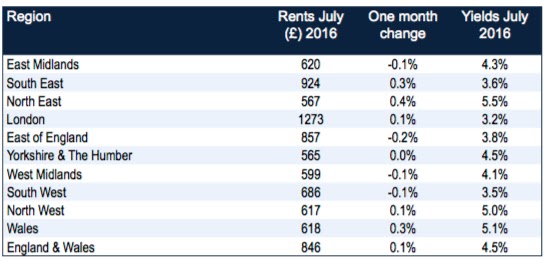

Latest TDS rental data

Steve Harriott, Chief Executive of the Tenancy Deposit Scheme comments:

“This data comes from landlords and agents registering new deposits on our database in August 2016 and advising us of the monthly rent that they charge. The figures show starkly the differential in regional rents across England and Wales”.

Sunday, September 18, 2016

Khan's new London planning incentives

Take advantage of our discounted landlord insurance ratesSadiq Khan's planning incentives for more London affordable homes https://t.co/rRo1VBVMG4

— Guardian news (@guardiannews) September 15, 2016

Saturday, September 17, 2016

Exemptions to housing benefit cap

Take advantage of our discounted landlord insurance ratesGovernment announces housing benefit cap exemptions to housing benefit cap after criticism https://t.co/itFHLTGFpg #ukhousing

— Guardian Housing (@GuardianHousing) September 15, 2016

Friday, September 16, 2016

Court date set for BTL tax challenge

Take advantage of our discounted landlord insurance ratesCourt date set for Cherie Blair's challenge to buy-to-let taxhttps://t.co/T4FHRoSjTT pic.twitter.com/qZWPjmCoxW

— Telegraph Money (@MoneyTelegraph) September 15, 2016

Report on Prime Scottish Property

Take advantage of our discounted landlord insurance ratesScotland's prime residential property market is showing resilience - new Savills report: https://t.co/e71cBo1M9H pic.twitter.com/iVOgmIpJDU

— Savills (@Savills) September 15, 2016

Thursday, September 15, 2016

Interest rates unchanged

Take advantage of our discounted landlord insurance ratesUK interest rates left unchanged at 0.25% https://t.co/eibtFYELeN

— BBC Business (@BBCBusiness) September 15, 2016

Can not getting married save SDLT on second property?

Take advantage of our discounted landlord insurance ratesWe're not married, so can we avoid higher stamp duty on a second home? https://t.co/jA30d98656

— Guardian Money (@guardianmoney) 15 September 2016

London 2nd most expensive city to rent

Take advantage of our discounted landlord insurance ratesLondon crowned second most expensive city to rent in the world - and with highest priced cinemas https://t.co/kPbwR4w0d5

— This is Money (@thisismoney) 15 September 2016

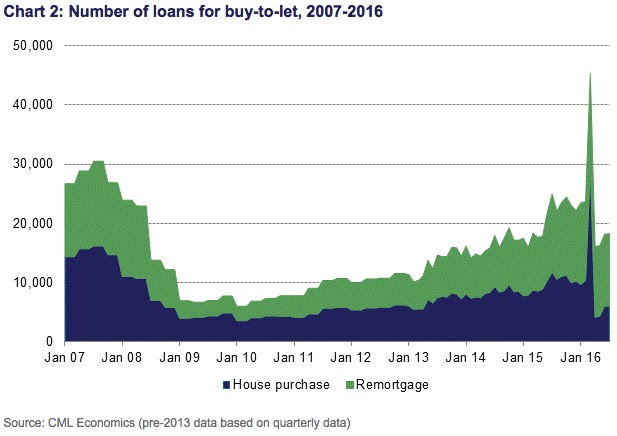

CML lending data from July

- Home-owners borrowing at £10.6bn, down 13% on June

- Total number of loans at 58,100, down 14% on June

- First-time buyers loaned £4.4bn, down 19% on June.

CML director, Paul Smee comments

"These figures cover the first full month of lending following the EU referendum. They show a month-on-month decline in first-time buyer and home mover activity and muted activity on the BTL market. It is hard to determine whether these figures reflect a first uncertain reaction to the referendum vote, or are a sign of a market which was already cooling. It will be quite some time before a full assessment can be made. We do believe that the Buy-to-let lending market is still readjusting after the large level of activity before the changes to stamp duty on second properties in April.

Remortgage lending on the other hand has continued to grow, and reacted with a 7-year monthly high. Borrowers seem keen to take advantage of the wide range of competitive deals in the market and, following the base rate cut in August, this is likely to continue."

Take advantage of our discounted landlord insurance ratesBrexit effect chills the housing market in July > client @SPFPrivClients comments https://t.co/EyTN4Bi648 via @ThisIsMoney— Melanie Bien (@melaniebien) 15 September 2016

HMRC starts sending text threats

Take advantage of our discounted landlord insurance ratesPing! Pay your tax now or face a penalty. HMRC starts to send 'threatening' SMS texts to taxpayers https://t.co/eDxEKw2Qyw

— Telegraph News (@TelegraphNews) September 15, 2016

Where is the property market heading?

Take advantage of our discounted landlord insurance ratesWhere is the property market headed next? Great data analysis from @JamesPickford2 https://t.co/W3CppgpYGi via @FT pic.twitter.com/NyeV6D0CdV

— Claer Barrett (@ClaerB) September 15, 2016

Rental yields still falling

The agency chain's data covering England and Wales shows -

- Annual rental growth of 5.2%, reversing recent trend.

- South East sees biggest annual rental growth, at 14.9 % over the year ( reflecting a London affordability exodus )

- The highest rental yields were in the North East at 5.5%

- The lowest rental yields are in London at 3.2%.

Adrian Gill, Director of lettings agents Your Move comments:

“Rents increased by 5.2% in the last year, suggesting the recent slowdown in rent rises may have come to an end.”

“The UK’s vote to leave the European Union has not caused any immediate change in the rental market, although we must wait for longer term trends to develop.”

“For landlords, market sentiment remains positive with the vast majority still looking to add to their portfolio of properties, despite the Brexit vote.”

“The South East was home to the biggest leap in rents, with many Londoners moving further a eld in an attempt to escape high rents in the capital.”

Rental Yields are still falling

The LSL data shows average gross rental yield for properties in England and Wales are still falling, down at 4.5% compared with 5.1% 12 months ago.

The best rental yields are to be found in the North East, now at 5.5% thanks to the regions cheap property prices.

The lowest yields are obviously in 'boom town' London, where the average rental yield now stands at just 3.2%, falling from 4.5% a year ago.

Wednesday, September 14, 2016

Who are Britain's landlords?

Take advantage of our discounted landlord insurance ratesWho are Britain's landlords? We reveal who's housing generation rent https://t.co/TW0dlU5ltJ via @ThisIsMoney

— Sarah Davidson (@SarahDavidson) September 14, 2016

Wembley 'rent to rent' landlord prosecuted

Take advantage of our discounted landlord insurance ratesWembley ‘rent to rent’ landlords prosecuted for running an unlicensed HMO https://t.co/VV3lNwSmvY pic.twitter.com/MYjgCnFqJo

— LondonPropLicensing (@lplicensing) September 14, 2016

Zone 5 prices best London performer

Take advantage of our discounted landlord insurance ratesZone 5 house prices are rising fastest in London for the first time in ten years https://t.co/Li3jupkNFb pic.twitter.com/iR670luMU8

— ES Homes & Property (@HomesProperty) September 13, 2016

An electrician to fix my heating?

|

| Landlords heating |

On first analysis that would seem sensible. Heating equates to plumbing and plumbers. However, after further enquiries it turns out that it is not the heating but the electrical heating control panel that has kaputt and needs replacing. So ironically, I don't need a plumber but an electrician. What is better for me is that my electrician is very good and wont charge a call out fee.

One of the important aspect of being a landlord is problem solving and getting the right man or women for the job.

Plumbers - how much should you pay?

Tuesday, September 13, 2016

UK house price inflation falls to 8.3%

The average UK house price is now £217,000, up by £17,000 over the course of 12 months, and £1,000 over the month.

England saw the strongest rise, with average annual price growth at 9.1%. The average property in England is now £233,000.

Take advantage of our discounted landlord insurance ratesUK House price inflation falls to 8.3% in July, says ONS https://t.co/qFUuRUpwxC— BBC Business (@BBCBusiness) September 13, 2016

UK regions see rent falls

Their data for August shows five out of nine areas saw a fall in rental values.

Countrywide pointed to a sharp increase in rental supply.

Johnny Morris, research director at Countrywide comments:

“In London and the South East, recent increases in the number of homes available to rent, outpacing the growth in tenants looking for a home, has meant that bargaining power is shifting towards tenants from landlords. This is slowing rental growth,”

One perspective on the current housing market

Take advantage of our discounted landlord insurance ratesPutting some perspective on the current state of the housing market #RESI2016 pic.twitter.com/Gwd2831a6T

— Lucian Cook (@LucianCook) September 13, 2016

Housing market cools - official figures

Take advantage of our discounted landlord insurance ratesHousing market cools in first post-Brexit official figures, but prices are still soaring https://t.co/btYqIiEDuB

— Telegraph Property (@TeleProperty) September 13, 2016

The Labour candidates housing policies

Take advantage of our discounted landlord insurance ratesHow do the housing policies of Jeremy Corbyn and Owen Smith measure up? https://t.co/eJwY88iiDF

— Dawn Foster (@DawnHFoster) September 11, 2016

House prices - is it just a wobble?

Take advantage of our discounted landlord insurance ratesA wobble, or the beginning of a fall? House price growth slows https://t.co/pzuT5KmgX5 pic.twitter.com/2cwDUj133S

— FTAdviser (@FTAdviser) September 13, 2016

Monday, September 12, 2016

Legal eagle berates 'rent to rent'

|

| Rent to Rent like printing money? |

Property Hawk is not alone in dismissing the whole exercise as a illegal sham.

One legal expert in this recent article refers to supporters as a confederancy of dunces.

HERE HERE! This is a well versed argument in a lot more depth and legal detail than I could ever muster into why the whole process doesn't and shouldn't work.

For genuine investors who want to get into renting property, you need to save up for a deposit and buy a property and then rent it out legally.

That's how you make money, not using get rich quick schemes invented and promoted by Property Gurus and Svengalis.

Landlord insurance - where do professional investors go?

Saturday, September 10, 2016

Rents rise to all-time high

Take advantage of our discounted landlord insurance ratesHome rents rose to an all-time high in July https://t.co/magTeEu3B9 #ukhousing

— Guardian Housing (@GuardianHousing) September 9, 2016

Friday, September 09, 2016

Licensing consultation - Ham&Fulham

Take advantage of our discounted landlord insurance ratesLandlord licensing consultation underway in Hammersmith & Fulham. Have your say https://t.co/6XQSD3gaRB pic.twitter.com/990qW0Ffg5

— LondonPropLicensing (@lplicensing) September 8, 2016

Are tenancy renewal fees fair?

Do landlords need a new tenancy agreement every 6 months?

This analogy is most appropriate for landlords that let through a letting agent who having signed up the tenant on a 6 month tenancy then proceeds to get the tenant to sign a new tenancy agreement every 6 months and charges both the tenant and landlord for this pleasure. WHY! Well there are obviously times that a new contract makes sense. If for instance the landlord wants to increase the rent every 6 months or there are changes in the occupation (for instance the tenancy becomes a joint tenancy) but for most parts a long standing tenancy just continues as a statutory periodic tenancy with rent being due from month to month. Any minor changes such as an decrease or increase in rent can be accommodated as long as both the tenant and landlord agree by just altering the existing tenancy (get your tenant to sign the amended copy).Are tenancy renewal fees fair or legal?

Well the answer to the 2nd part of the question is that they are legal if the agency agreement stipulates it. So if you don't want to pay every 6 months make sure before signing up with the letting agent that they are aware of this and are happy to proceed on this basis. Otherwise go elsewhere.Should a letting agent have a duty of care?

Are tenancy renewal fees fair? At the heart of this question is whether you believe a letting agent should be acting in the best interest of the client aka the landlord or whether they work on the basis of maximising their own profits exploiting their landlords as they would with any other customer. Many naive first time landlords assume wrongly that they clearly act in the first way having a duty of care toward them. Clearly renewal fees are warranted if a legitimate service is being provided with a well informed and educated letting agent acting in the best interest of their landlords. In far too many situations this is not the case.For more information on tenancy renewal fees

Landlord insurance - expert brokers - professional rates

Thursday, September 08, 2016

New BTL trackers offer flexibility

Accord has launched two new 2 year tracker rates for buy-to-let clinets with no Early Repayment Charges ( ERCs) and a free valuation. The rental calculation is 125% at 5.50%.

At the end of the deal period, customers will revert to the lenders Standard Variable Rate less a discount of 1.75% ( currently 4.04%) until the 5th anniversary.

As no ERCs apply during this period, customers can at their leisure, sell their property, remortgage to another lender, switch to another Accord product or remain on the discounted rate. In the current uncertain market conditions, these products offer a high degree of flexibility for landlords.

Accord tracker product details

- 2.69% 2 year tracker up to 65% LTV

- 2.90% 2 year tracker up to 75% LTV

- Reverts to SVR less a discount of 1.75%( currently 4.04%) until 5th anniversary

- Rental calculation of 125%

- Free standard valuation for purchases and remortgages

- Free legal fees for remortgages only

- No Early Repayment Charges

- £130 booking fee

- £300 completion fee

- An application fee will normally apply

6 BTL properties for under £40k

Take advantage of our discounted landlord insurance rates6 buy-to-let homes for under £40k https://t.co/3Okstj9wAg pic.twitter.com/eihRj25ds0

— Zoopla (@Zoopla) September 8, 2016

Landlord fires shotgun to frighten tenants

Landlord Marcus Strong, 64, shot his gun into the air as he walked towards the tenants before announcing they had five minutes to vacate the mobile home.

Mr Strong was described as having 'lost control'.

The tenants, an elderly couple, managed to ring for police before Strong grabbed the phone and broke it in half.

The mobile home was sited in the grounds of Mr Strong's home at Gunthorpe Lane, Briningham, Melton Constable.

Strong’s firearms licence has since been revoked .

Halifax HPI for August reflects slowdown

Halifax housing economist, Martin Ellis says:

"House prices in the three months to August were 0.7% higher than in the previous quarter; down from 1.5% in July. The annual rate of growth fell from 8.4% in July to 6.9%.

House price growth continued the trend of the past few months in August with a further moderation in both the annual and quarterly rates of increase. There are also signs of a softening in sales activity.

The slowdown in the rate of house price growth is consistent with the forecast that we made at the end of 2015. Increasing difficulties in purchasing a home as house prices continued to increase more quickly than earnings were expected to constrain demand, curbing house price growth.”

Take advantage of our discounted landlord insurance rates

Falling prime London rents

Our latest Prime Central London research features in today's @FT story https://t.co/GD398bPAX9. Full report here: https://t.co/2dNFVxKU5y

— Knight Frank (@knightfrank) September 8, 2016Take advantage of our discounted landlord insurance rates

Surveyors feeling a bit more confident

12% of surveyors reported seeing price increases up from the low of just 5% in July. However this upswing in confidence does follow the five month run in falls, and is still way down on the high, recorded 18 months ago, when surveyor confidence hit 50%.

RICS chief economist,Simon Rubinsohn comments:

August's sales volumes also showed signs of stabilising with the RICS agreed sales indicator improving to zero from -32%.

News | #RICSresi Market Survey shows rebound in #UKhousing market post referendum dip: https://t.co/FqVDOtyzdV pic.twitter.com/xisk0XKxCE

— RICS (@RICSnews) September 8, 2016

UK housing market settles down post-Brexit, says Rics https://t.co/hivHgM4qCv

— BBC Business (@BBCBusiness) September 7, 2016

Homes market firms: lack of supply, rate cut, @scotgov policy helps, says @RICSnews

— Douglas Fraser (@BBCDouglasF) September 8, 2016

Edinburgh + SE prices up: @espc https://t.co/2OvssKi2NH

News | #RICSresi Market Survey shows rebound in #UKhousing market post referendum dip: https://t.co/FqVDOtyzdV pic.twitter.com/xisk0XKxCE

— RICS (@RICSnews) September 8, 2016

Take advantage of our discounted landlord insurance rates

BofE could cut rates further this year

Take advantage of our discounted landlord insurance ratesBank of England could cut rates again this year https://t.co/pY3Db4ISkU pic.twitter.com/bO51SHG4tm— Financial Adviser (@FANewsdesk) September 8, 2016