The Nationwide House Price Index for September is out, showing:

- London's first price fall since 2005, down 0.6% year-on-year.

- UK annual house price growth stable at 2.0%.

Nationwide's Robert Gardner comments:

“The annual rate of house price growth remained broadly stable in September at 2.0%, compared with 2.1% in August.

Housing market activity, as measured by the number of housing transactions and mortgage approvals, has strengthened a little in recent months, though remains relatively subdued by historic standards.

Low mortgage rates and healthy rates of employment growth are providing some support for demand, but this is being partly offset by pressure on household incomes, which appear to be weighing on confidence. The lack of homes on the market is providing ongoing support to prices.

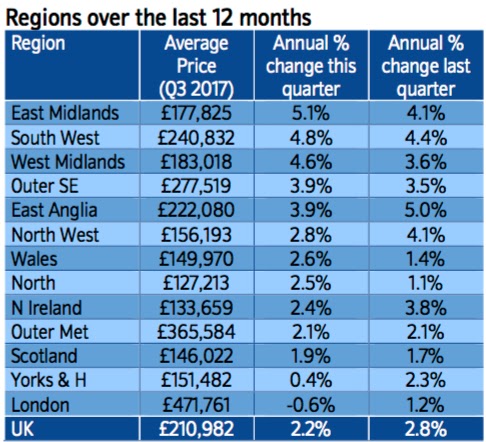

House price growth rates across the UK have converged in recent quarters. Annual growth rates in the south of England have moderated towards those prevailing in the rest of the country. London has seen a particularly marked slowdown, with prices falling in annual terms for the first time in eight years, albeit by a modest 0.6%. Consequently, London was the weakest performing region for the first time since 2005.

At its September meeting, the Bank of England’s Monetary Policy Committee (MPC) signalled that, if the economy evolves broadly in line with its expectations, an interest rate increase is likely in the months ahead. This would be the first increase in the Bank Rate since July 2007.

Clearly, much will depend on how the economy evolves, but most economists and financial market pricing suggest that a small rise of 0.25% is likely at the MPC’s next meeting in November, which would take Bank Rate to 0.5%.

We would expect a modest rise in Bank Rate, by itself, to have only a modest impact on economic activity. Indeed, if rates are raised to 0.5%, monetary policy settings will still be a little more supportive than they were before Bank Rate was lowered to 0.25% in August 2016.

This is because the MPC is unlikely to reverse the other measures it put in place last year to support credit availability in the wider economy (such as the additional purchases of government and corporate bonds, which have helped to keep longer term borrowing costs low). Moreover, the MPC has signalled that it expects any increase in interest rates to be gradual and limited. Indeed, financial market pricing suggests that Bank Rate is only likely to rise by around one percentage point (to 1.25%) over the next five years."

London house prices 'fall for first time in eight years' https://t.co/ymGNfrPPkr— BBC Business (@BBCBusiness) September 29, 2017

Manchester soars as London records real house price falls https://t.co/WcAwa8zOrT— Telegraph Property (@TeleProperty) September 28, 2017

London house prices fall for the first time since 2009 https://t.co/43SsgsKBPb #property

— Property PR (@propertypr) September 29, 2017

Take advantage of our discounted landlord insurance ratesLondon house prices have fallen for the first time in eight years https://t.co/RYcpy5BYCr pic.twitter.com/XC8bqxY849— City A.M. (@CityAM) September 29, 2017

No comments:

Post a Comment