The BTK sales market is seeing a recovery in activity following the April dip caused by the introduction of the 3% stamp duty surcharge.

Rightmove’s Head of Lettings Sam Mitchell comments:

Rightmove’s Head of Lettings Sam Mitchell comments:

“Investor activity has bounced back following the stamp duty changes, though some agents report that many investors are looking to knock sellers down on their asking prices to make up for the additional stamp duty they now need to pay. New rental supply has held up despite concerns that the stamp duty changes would lead to less fresh stock.

Once again Essex and other commuter spots are offering investors the best total returns, and those looking at long-term investments are seeking out areas with upcoming improved transport links. The changes starting in 2017 to lessen mortgage interest tax relief may see some seriously review their businesses and could scale back, though there appear to be no signs yet of landlords exiting the market. If supply of property to rent does scale back those that will win in the long term will be less highly-mortgaged landlords that chose not to sell off their property, and the big winners could be those that are investing in the right areas now. We expect some of the supply gap to be filled by Build to Rent but it could take some years for this to seriously increase rental stock levels. With this in mind 2017 could be another year of increasing rents.”

Key Points

- BTL buyer enquiries up 30% since May.

- This quarters new rental listings up 6% on this period last year.

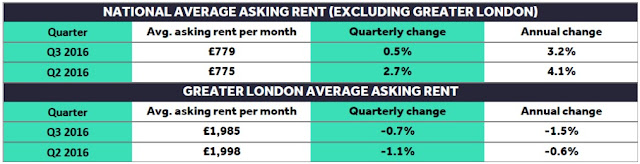

- Asking rents falling in London, down 0.7% on last quarter.

Download the Rightmove Rental Trends Tracker for Q3 2016

The latest Rental Trends Tracker is out - find out what's changed this quarter in rental prices across the country > https://t.co/LNuXUCKje3 pic.twitter.com/SDJ6UFQD5o

— Rightmove (@rightmove) October 12, 2016

Take advantage of our discounted landlord insurance rates

No comments:

Post a Comment